We want to share two examples of brand trashing and, for complete contrast, a great example of recovery. Also, we’ll look at a simple formula you can use to think about how well you deliver value to your customers.

You must have had experiences where promises made by the organisation that wanted your business were not delivered. This breaks trust in the brand which is tough to rebuild.

These are three real life customer experiences from the banking and printing industries. We help organisations design and deliver compelling customer experiences so these three events will go straight into our casebook as standouts on how to –

- prove your advertising is nothing but spin, or

- recover from a potentially bad experience and secure loyalty

Customer experience #1. New business? Come back later

Wanting to open a business account to deposit a large sum, we went to the business branch of a major bank, whose constant advertising stresses their high level of commitment to meeting the needs of their customers.

We waited over half an hour. We were finally directed to the person handling new business only to have him announce that he was new to this role and in training so he couldn’t open a business account.

We asked him to find someone who could help us. Minutes later he returned to say no one else was available to assist but if we didn’t mind waiting another half hour or so someone senior might be back from lunch.

Meeting the needs of their customers was not a priority for this bank.

Their ads lied about the customer experience they promised!

Naturally we left and opened the account at another bank where trained people were available.

Customer experience #2. Same bank, same result

A year later we decided to give the first bank another try. They were still running the same ads stressing their commitment to meeting the needs of customers.

We went into a large branch in the central CBD to open a business account, thinking they must have more staff than a suburban branch.

Took a ticket and waited. Watched the screen like a hawk but only to see other ticket numbers called. Watched repetitive trivia questions and product promos on the same screen – bored!

Half a lifetime or 35 minutes later we got the call to desk 2. The pleasant young man

- Listened to our request to open a business account and then –

- Announced this was something he couldn’t do as he was only a trainee.

- He scurried off to find someone senior to help.

- Returned 5 minutes later to say no one was available to assist so

- Could we please make an appointment and come back another day.

Hey customers – you’re not important, we are!

We insisted on seeing someone senior and after another wait the branch manager arrived to explain that –

- Anyone who could assist was tied up in meetings so we could either wait another 40 minutes or so for someone to be free or

- Make an appointment for another day. We declined another wait and asked to speak to someone more senior.

- The branch manager said no one more senior was available but he took our office number and said he would ask his manager to call us.

- You guessed it – Resounding silence!

Got to give them marks for consistency – still running the same ads with the same lies!

The bank that couldn’t help us (twice) spends a lot of money advertising to attract new business customers. It seems to be paying for the advertising by cutting the number of trained staff who can sign up these new customers.

Customer experience management, customer loyalty and building customer advocacy seem to be just phrases without meaning for this bank.

Customer experience #3. Customer service recovery

Leaving the bank with steam coming out of our ears, we walked a few doors to a major copying and printing business to find out why business cards with our changed office address were taking more than a month to produce.

The manager immediately responded by –

- saying this was unacceptable service,

- that she would have the cards delivered to us in the next two days

- and that there would be no charge for designing and printing.

This was a great recovery and turned a potentially bad experience into a really good one. We’ll be using them again.

What do customers value?

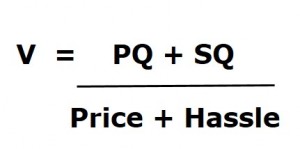

We could sum up what customers value by this equation developed by one of our UK colleagues, Shaun Smith

©Shaun Smith 2004

Value equals Product Quality (PQ) plus Service Quality (SQ) over Price plus Hassle.

From the customer viewpoint –

- Product Quality is what they get and

- Service Quality is how they get it.

- Hassle is any difficulty factor in buying the product or maintaining it.

Can you see in the banking examples that Service Quality rated zero and the Hassle factor was high. The printer got similar scores at first but recovered by shifting Service Quality to 10 and cutting the Price and Hassle factor to 0.

How does your organisation rate on the Customer Value equation?

Please take a few seconds to share this because sharing ideas helps all of us to improve performance.

You’ll find ideas on how to improve customer experience in our book BUILD Your Business; From Ordinary to Extraordinary: 5 Steps to High Performance.

To get your copy of this book, or to download a free sample chapter, click here

John Dawson & Carmel McDonald are the co-owners of Dawson McDonald Consulting. They’ve helped hundreds of organisations and their people improve performance, to increase business results and customer loyalty. Since 2005 they’ve been accredited as experts by the International Society for Performance Improvement (ISPI). They can be contacted at info@dawsonmcdonald.com.au

Cartoon Image: Shutterstock